Before I get into the details of my proposal’s cost I must provide a very important caveat. My proposal is only for those yet to be born. Read that again. That is, no one alive at this moment in time will partake of the Social Security IRA system I am proposing. However, if it can be implemented, then the children and grandchildren of those living today would benefit. Again, I cannot over stress the importance of long term thinking. We want to build a robust social safety net for mid-century when a great many transformational technologies are likely to have matured.

By the 2050’s the nature of work will have substantially changed. We cannot assume corporations and their pension plans will last for decades. It is far more likely that businesses will rapidly rise and fall based on the vagaries of explosive technological change. Tying retirements to IRAs with mixed portfolios would allow all American workers to enjoy the benefits of what is likely to be an explosive growth economy but one where no single corporation dominates for very long. My proposal would allow all American workers to take advantage of market growth via their IRAs. It does so by providing all workers with a reasonable sum of capital to function as seed money, allowing all workers to leverage compounding interest to build wealth and have passive income stream through the natural upward trend of the market. We need a social safety net for more than those age 65 and older—we need one for all Americans.

My Social Security IRA construct offers such a system. However, we must establish and implement it ethically. That is, we cannot forsake the legacy Social Security system in our reform efforts. We cannot harm the investments that American workers have already made. So how do we do this? How do divest our nation from the legacy, out-dated Social Security system and transition to the far more beneficial and expansive Social Security IRA option that I have outlined in my previous two posts?

Read on to find out.

[If you have not read Parts I and II of this series I recommend you review them before reading further].

Ethically Reforming The Legacy Social Security System

Whenever we talk about reforming Social Security we must be mindful that many Americans have spent their working lives paying into Social Security and it is therefore only fair—only just—that they now receive the return on their investment. It is immoral to cast aside the lifetime investments of the former and current generation of American workers. Therefore, in implementing my proposed Social Security IRA system we must ensure the legacy system remains solvent and functional. Fortunately, my proposal does not really affect anyone alive. That is, my proposed Social Security IRA system is for those who are not yet born. It will affect only those born after the implementation date.

In order to keep the legacy Social Security system solvent, the beneficiaries of my IRA construct would be required to fund the legacy system via continued FICA taxes. This is only fair considering that if my proposal were implemented, the present generation of tax-payers would essentially fund the Social Security IRA system and not receive any personal benefit. The beneficiaries of the new system would contribute their tax income to keep the present system solvent so that the current and former generation of workers are still provided for.

My proposal marginally impacts the present Social Security system. It would eventually supplant it but payments would continue into the legacy system until no longer necessary. However, if the present system remains intact, and presumably funded, where will the funding for my new Social Security IRA system come from? How do we finance this new system and how much will it cost the Federal Government?

The Cost

At first glance, my proposal will seem financially absurd. Assuming there are approximately 4 million US citizens born every year, the Federal Government would spend $1 trillion per year seeding $250,000 Social Security IRAs for each of these newborns.1 How would the Federal Government fund $1 trillion in new, annual expenditures?

It is estimated that the Federal Government will receive $4.174 trillion in revenue in Fiscal Year (FY) 2022 (October 2021 - September 2022).2 Of this revenue, approximately $1.688 trillion is estimated to be discretionary funds.3 Discretionary spending is money that the Federal Government is not obligated to spend by law but has chosen to spend out of its projected revenues—hence it is ‘discretionary’. In fiscal Year 2021 (October 2020 - September 2021) the Trump Administration requested $1.485 trillion in discretionary spending.4 As can be seen, projected discretionary spending is likely to grow every year as Federal Revenues grow each year.

In order to avoid deficit spending the Federal Government would have to limit discretionary spending within the bounds of the $1.688 trillion it is expected to receive in revenue. This is where my proposal gets a little challenging. After all, the Government cannot use $1 trillion of its $1.688 trillion in discretionary spending solely to fund my all Social Security IRAs proposal. If it did, it would only have $688 billion to divide among all its myriad agencies. This is hardly realistic. Therefore, my proposal would have to be implemented incrementally. It can be established by starting at a small investment and scaling it up over several years. In this way, the Federal Government could avoid deficit spending and retain a level of flexibility in its discretionary spending.

Implementing Reform through Modular Design

At implementation, the first round of seed money could be scaled down to just $50,000 per newborn American citizen instead of my proposal’s $250,000. This would cost the Federal Government about $200 billion a year on 4 million newborns. Using this as the first generation of the Social Security IRA system we see that it provides largely the same retirement outcomes as my full proposal. However, the Age 30 withdrawal is greatly reduced. A worker’s Social Security IRA’s worth at the Age 30 withdrawal would be about $380,000 with $130,000 accessible if no contributions were made. The benefits of this system are tabulated below:

The 30 Year Value of $50,000 IRA (no contributions made): $380,000

The 30 Year Value of $50,000 IRA (maximum contributions made): $1.51 million

The 30 Year Value of $50,000 Social Security IRA (mean valuation): $945,000

As can be seen, starting with a $50,000 seed fund greatly reduces the Age 30 withdrawal sum relative to the full, proposed amount of $250,000. However, the retirement outcome would largely remain the same as a worker would still be required to keep $250,000 in their IRA after the Age 30 withdrawal.

In order for the Federal Government to scale-up IRA seed money distribution it could freeze discretionary spending at a certain baseline for a couple of years. For example, let us compare discretionary spending differences between Fiscal Years.

Spending Differences:

Approximate Discretionary Spending FY2021: $1.5 trillion

Approximate Discretionary Spending FY2022: $1.7 trillion

Difference (surplus): $200 billion

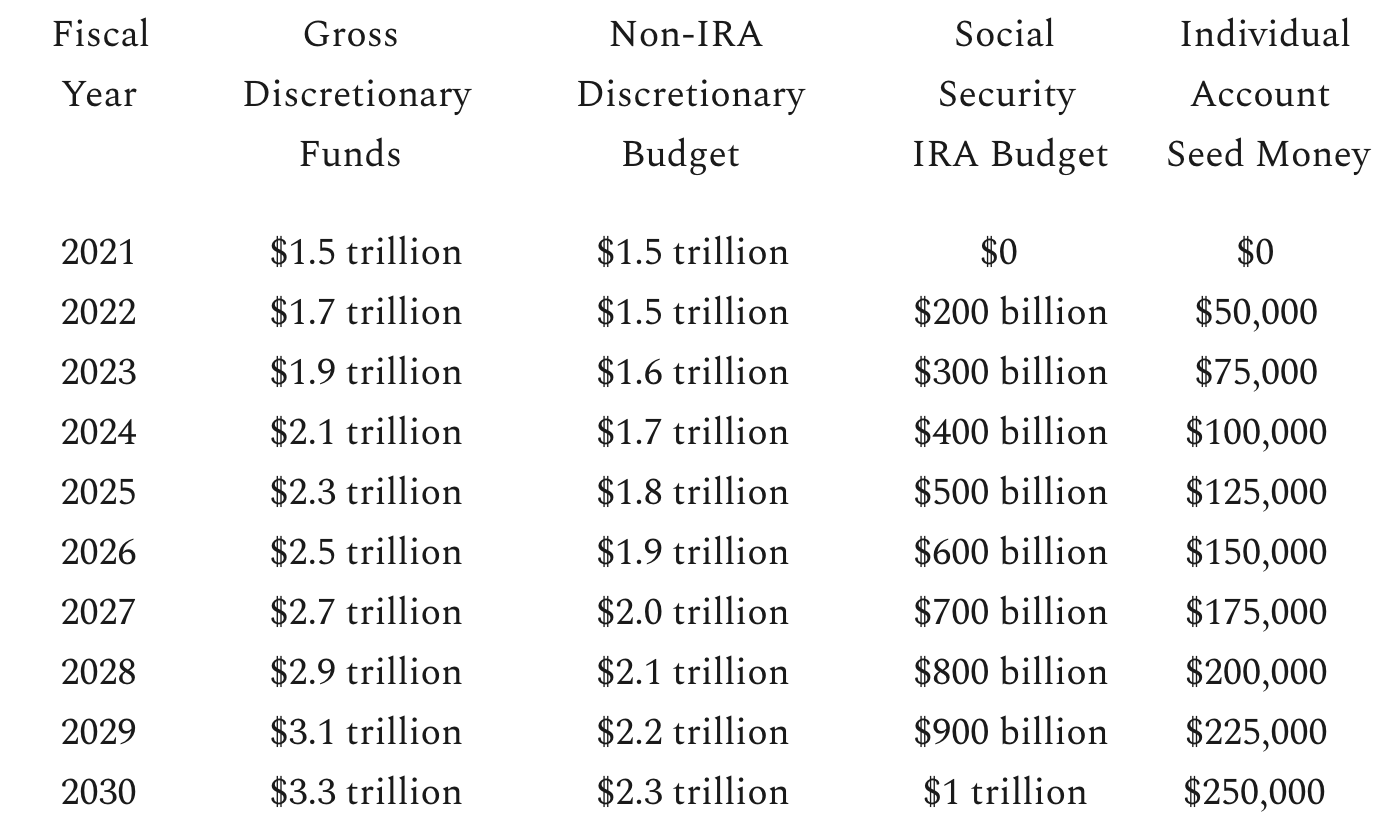

We can see that if Federal Discretionary spending were frozen in FY2021 then with the surplus of $200 billion the initial seed money for my proposal would already be earned without any deficit spending whatsoever. Every Fiscal Year after 2022 the approximately $200 billion increase in revenue could be split between discretionary spending funds and funds for Social Security IRAs. Each would grow at about $100 billion per year. The tabulation below shows how the funding for my proposed Social Security IRA system could be secured:

As can be seen, if my proposal were implemented immediately, then by FY2030 my proposal would be fully budgeted for—without any deficit spending. This would also be accomplished with zero changes to the legacy Social Security system. This rudimentary plan allows for discretionary budget funds to grow at a rate of $100 billion a year while the Social Security IRA budget also grows by about $100 billion a year. Seed money payments would ratchet upwards from $50,000 per newborn to $250,000 per newborn after a 10 year period. Each year seed money payments would increase by $25,000 per newborn, per year until the ideal goal of $250,000 is reached. Although seed money of $50,000 and $100,000 certainly is not as impressive or as ideal as the $250,000 baseline of this proposal, it is important to remember that the Federal Government must find a way to ease into this new system and this is the most fiscally responsible way of doing so without adding deficit spending.

The Federal Government could finance my proposal through simple budget discipline. Furthermore, after 10 years, the Government’s non-IRA Discretionary Budget could grow at about $200 billion a year again. It would only ‘suffer’ a decade of slow budget growth ($100 vs. $200 billion) for discretionary funds. This is well worth at is, during this period, its discretionary spending still grows (just at a slower rate) while it maintains the legacy Social Security system in conjunction with establishing my proposed IRA reform.

Setting aside all the benefits previously highlighted in my proposal, it is important to examine a few second and third order effects which also off-set the cost.

Benefits Outweigh the Costs

Perhaps one of the first and most obvious benefits of my proposal is that the annual injection of Federal seed money into Social Security IRA’s functions as a kind of fiscal stimulus. This money gets injected back into the economy via accounts established by banks. These private businesses are free to utilize the funds in whichever way seems wise to them within the bounds of existing laws. This proposal leverages the wealth creating power of the market. The banks approved to offer Social Security IRAs would be awash in investment capital. This would accrue to the benefit of a great many communities as smaller, local banks would likely have far more money to finance parochial projects as funds trickle down to them. This stimulus effect has the third order benefit of driving job creation and wage growth.5 Even starting from the first year of implementation with only $50,000 in seed money per account, the Government would still be injecting $200 billion into the market via investment accounts. Once fully implemented, it would be injecting about $1 trillion a year into the financial system (again, without using deficit spending).

Another advantage of my proposal is that as more and more workers benefit from the Social Security IRA program the less they would require Federal assistance for other expenses. As alluded to in previous posts, when workers access their Age 30 withdrawal they could use it to cover a great deal of expenses that might otherwise pass to the Federal government via student tuition grants or Medicaid/Medicare. Under my proposal, the Federal Government would make a significant ($250,000) one-time payment towards a worker and then over the course of that worker’s lifetime it could recoup that investment via tax revenue. It could also increase savings through divesting itself from expensive Federal assistance programs. This frees Federal welfare funds for those who are unable to even do part-time work—such as individuals with significant disabilities. This financial windfall could be redirected to other government concerns such as infrastructure investments or research grants.

A further advantage of my proposal is it’s agnosticism towards a person’s socio-economic or ethnic status. All that is required is US citizenship. Thus, workers from poorer or historically disadvantaged backgrounds who might not, under other circumstances, be able to finance professional degrees would have access to more educational opportunities through leveraging their Age 30 withdrawals. People could use some of their withdrawals as collateral to obtain small business loans or even venture capital. Ultimately, it gives a significant financial boost to workers at the start of their careers and allows them to take better advantage of educational or entrepreneurial opportunities without worrying about incurring multi-decade debt commitments. It allows America to cultivate its human capital which in turn would result in increased worker productivity.

Conclusion

Fundamentally, my proposal is about fostering social stability through the establishment of what is quite obviously a robust, adaptable and highly beneficial social safety net. It is a proposal which offers a secure prosperous retirement option for all workers. It also offers a universal, passive (basic) income option for every American as well. By reversing the Federal Government’s investment philosophy towards Social Security I have illustrated a way in which our nation can leverage compound interest to craft a very robust social safety net. One which allows American workers to pay off most of their debts as well as establish a passive income stream. It offers them a robust, retirement ‘nest-egg’.

It achieves these very Progressive goals through leveraging the power of the free market—a mechanism ironically celebrated by many Conservative Americans. My proposal is a Centrist solution. All of the benefits I have articulated (and likely many more) are quite accessible and possible for our country. What we must do is convince our elected leaders to see past the short term election cycles of 2, 4 and even 6 years. They must think decades ahead. In doing so they would posture or country for fantastic wealth growth and wage stability as we travel through what is likely to be a very turbulent century.

***Note***: If you have liked this series and agree with my proposal I kindly urge you to share it with as many people as possible. The only way we spread good ideas is by sharing them. Even if you disagree with my thoughts still share them—at the very least you might find it will stimulate some engaging debates.

This figure is based off of the listed number of births in the United States in 2018 and is rounded up for simplification purposes (see Bill Chappell, “U.S. Births Fell to a 32-Year Low In 2018; CDC Says Birthrate Is In Record Slump,” NPR, May 15, 2019, https://www.npr.org/2019/05/15/723518379/u-s-births-fell-to-a-32-year-low-in-2018-cdc-says-birthrate-is-at-record-level).

Kimberly Amadeo, “U.S. Federal Budget Breakdown: The Budget Components and Impact on the U.S. Economy,” The Balance, October 3, 2021, https://www.thebalance.com/u-s-federal-budget-breakdown-3305789.

Kimberly Amadeo, “U.S. Federal Budget Breakdown: The Budget Components and Impact on the U.S. Economy.”

Kimberly Amadeo, “Current U.S. Discretionary Spending: FY2021 Budget Request,” The Balance, May 9, 2021, https://www.thebalance.com/current-us-discretionary-federal-budget-and-spending-3306308.

Sean Williams, “The Pros and Cons of Privatizing Social Security,” The Motley Fool, July 16, 2018, https://www.fool.com/retirement/2018/07/16/the-pros-and-cons-of-privatizing-social-security.aspx. In his article Sean Williams lists privatized Social Security investments as a boon for “job creation and higher wages” through the infusion of capital into the economy and highlights it as one of the possible benefits to privatizing the program.